What is the best ecommerce payment gateway?

2 min read

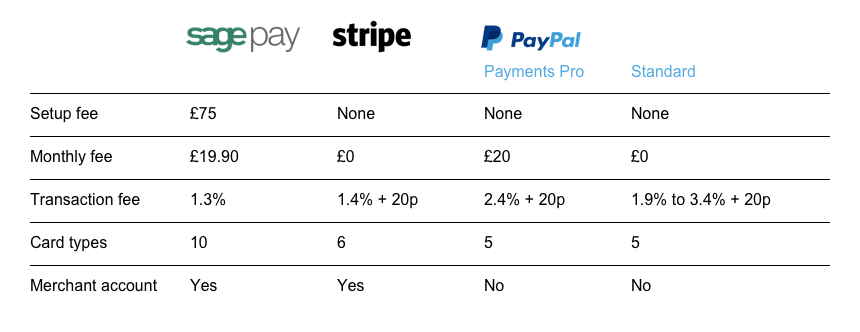

If it was that simple there’d probably only to be a few payment gateways to choose from, unfortunately, it’s a really competitive space with wide ranging setup costs, monthly fees, transaction fees, qualification criteria and terms.

How to find the most suitable platform

We highly recommend a simple independent tool provided by Payment Brain, by entering your current or anticipated number of transactions per month and average amount per transaction, you’ll receive an exhaustive list of service providers to compare.

https://www.paymentbrain.co.uk/payment-gateways

Change is good

It is likely that your volume of transactions or average order value will change as your online business evolves, therefore it might be necessary to change to a different gateway which better suits your needs. Don’t be scared to change, yes it is a little hassle but can be worth the short-term pain for the long-term gain. You should regularly review what’s on offer from your existing and other payment gateway providers, much like the telcos and energy providers, there is no guarantee you’re getting the best deal even from your incumbent supplier.

Many clients launch their online businesses using Paypal which is quick and easy to setup and start trading, and then subsequently implement additional gateways or switch to a different provider when the time is right (or shortly after).

Granite 5 recommendation

We like to stick with the major players, they usually provide better levels of support and customer services, and also much really professional documentation which is required by our developers when working on the integration.

For many of the leading providers, WordPress and/or Woocommerce plugins are available to make implementation much easier. We have recently enjoyed working with the following gateways:

- Stripe – great for charities

- Paypal

- Skrill

- Braintree (part of Paypal)

- Sagepay

- Worldpay – don’t offer a free sandbox (testing) environment

Other considerations

Some service providers will include a merchant account, however, you’ll need to source and buy this service from your bank or a 3rd party if not.